The United States has an extraordinary amount of tax laws, regulations, and directives that are altered with each new fiscal year and election cycle. In fact, there are over 2,600 pages of tax code that is exclusively Federal, therefore leaving interpretation and implementation into individual states’ tax laws as well. For an average citizen and worker, these laws and codes can present confusion, anxiety, and frustration, as even the most experienced tax experts can get lost within the thousands of regulations.

However, the best way to understand U.S. taxes is to distinguish the types of taxes. Within the 2,600 pages of tax code, there are 12 categories of taxes that organize individual and company revenue and differentiate different tax brackets. Besides these 12 specific categories of taxes, there are three main typologies: Earning, Buying, and Owning.

Under these umbrella terms, a taxpayer can understand the way that State and Federal governments identify how to tax different items. For example, Earn taxes are targeted at categories such as individual income tax, payroll taxes, and corporate income. Buy taxes refer to those taxes that are automatically included when you buy a service or good, such as sales tax, VAT, or excise taxes. The final umbrella, Own taxes, are targeted at assets. These are property taxes on real estate, inheritance taxes, and general wealth taxes.

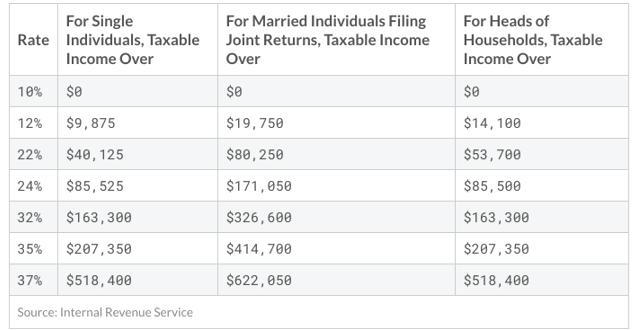

With this understanding, a taxpayer can begin to understand the most taxed category: Earning. This is most commonly known as the taxes that an eligible taxpayer must pay in April during peak tax season. These are most often individual income taxes that gradually increase on a progressive scale, depending on your earnings. These brackets often change with each new political administration or tax laws, so it is important to refer to the Internal Revenue Service’s (IRS) website each year to understand the tax bracket that you will fall under.

When employed on a business or company’s payroll, these taxes are often automatically withheld from your paycheck and managed by the company’s administrative team. However, companies or taxpayers working as contractors, freelancers, or separate from a payroll, these taxes must be withheld and put aside by the individual, as it is their responsibility to manage. With over 40% of the United States’ workforce having additional, supplemental income through freelancing, contract work, or ‘side-gigs,’ this has become a new challenge to taxpayers across the country, as the uncertainty and lack of clear information regarding this personal withholding can be confusing.

The golden rule is to set aside approximately 30% of your income for taxes and estimated payments. Based on your income, this rule should cover all of the taxes that you will owe both federally and state-wise, therefore it is essential to have the discipline and organization to set aside these earnings with each payment. If you struggle to do this, we can also organize and oversee this simple process for you to ensure that your taxes are prepared ahead of schedule, estimated payments are made without penalty, and you are completed focused on expanding your business and career.

Outside of gig-workers, the other most common type of tax that applies to the general taxpayer is Capital Gains Tax. Simply, any asset that is owned for personal use, investment, or for pleasure, such as stocks, cars, jewelry, art, or more is subject to a Capital Gains Tax is the asset increases in value. For example, if an average taxpayer purchases a home for $100,000 and sells the home for $150,000, the profit of $50,000 is subject to a Capital Gains Tax.

Here at Winn Financial, we offer clear-cut, affordable services to distill complex tax codes into understandable insights. We excel in providing personable and simplified services to serve as your one-source solution among all of the high volume, corporate services that see your finances as a lucrative source, rather than your personal livelihood. Our financial advice and services are rooted with one rule: integrity. As we offer solutions for all of your tax questions and problems, our services include a diverse range of offerings, including asset management, financial and business advising, business accounting, and tax services.